AU SAR1 2022-2025 free printable template

Show details

SAR1

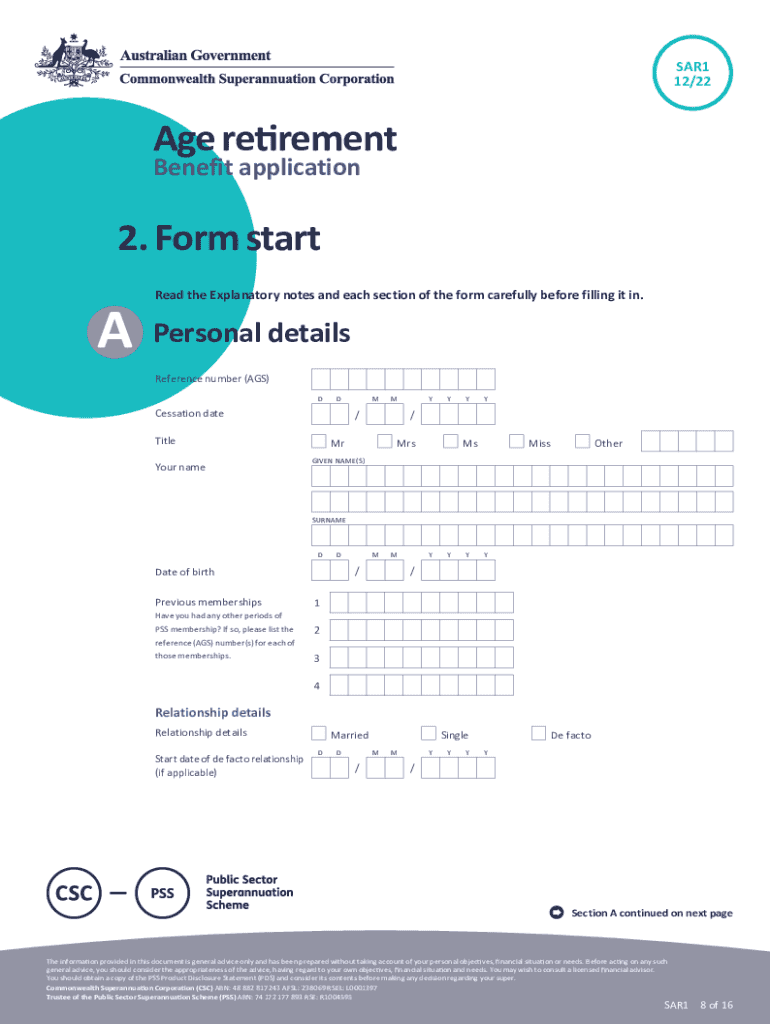

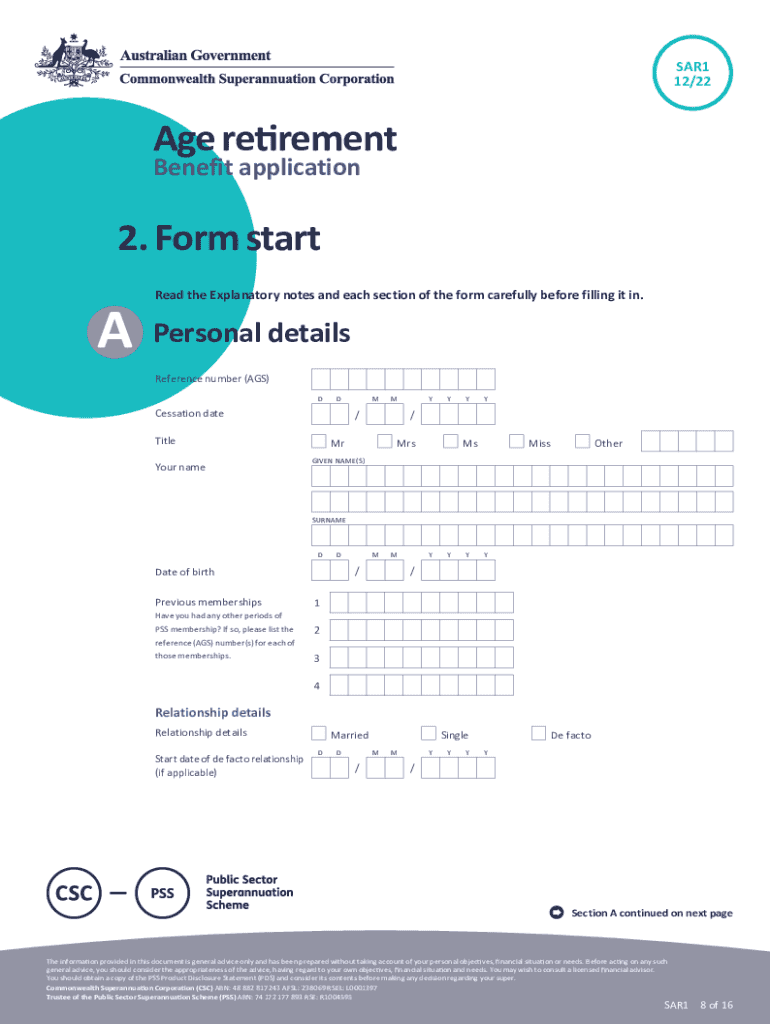

12/22Age retirementBenefit application1. Explanatory notes

2. Form

Important information about this form

What this form is forth benefit application form and Explanatory notes are to be used

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign age retirement benefit application form

Edit your age pension application form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your au csc retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit age retirement benefit application form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit au csc retirement form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU SAR1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out au csc retirement get form

How to fill out AU SAR1

01

Begin by gathering all required information about the reporting entity.

02

Fill out the identification details, including the entity's name and address.

03

Provide the details of the transaction or activity being reported.

04

State the reason for suspicion clearly and concisely.

05

Include any relevant dates connected to the activity.

06

Ensure all fields are filled out accurately to avoid delays.

07

Review the completed form for any errors or missing information.

08

Submit the form through the appropriate channels, either online or in print.

Who needs AU SAR1?

01

Financial institutions required by law to report suspicious activities.

02

Businesses that are obligated to report certain types of transactions.

03

Individuals or entities that have knowledge of potentially suspicious financial activities.

Fill

au csc retirement get

: Try Risk Free

People Also Ask about commonwealth superannuation corporation retirement blank

When can I start applying for retirement benefits?

You can start your retirement benefit at any point from age 62 up until age 70.

How do I start the retirement process?

Saving Matters! Start saving, keep saving, and stick to. Know your retirement needs. Contribute to your employer's retirement. Learn about your employer's pension plan. Consider basic investment principles. Don't touch your retirement savings. Ask your employer to start a plan. Put money into an Individual Retirement.

How do I claim my retirement pension UK?

You will not get your State Pension automatically - you have to claim it.You can claim the basic State Pension by either: calling the State Pension claim line. downloading the State Pension claim form and sending it to your local pension centre. claim from abroad including the Channel Islands.

Can I apply for Social Security retirement at age 62?

You can receive Social Security retirement benefits as early as age 62. However, we'll reduce your benefit if you start receiving benefits before your full retirement age. For example, if you turn age 62 in 2023, your benefit would be about 30% lower than it would be at your full retirement age of 67.

What's the earliest you can apply for retirement?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

How do I apply for retirement in the UK?

How do I claim my State Pension? Online. You can claim your State Pension online 24 hours a day, 7 days a week. Phone. To claim over the phone, call the Pension Service claim line on 0800 731 7898 (textphone: 0800 731 7339). Post. You can also fill in a claim form and return it by post.

How long before my 62 birthday should I apply for Social Security?

You can apply for retirement benefits up to four months before you want to start receiving your benefits. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

What documents do I need to claim State Pension?

Provide documents Your national insurance number (and partner's, if you have one) Proof of your identity (for example, your passport, birth certificate or driving licence) Marriage certificate or civil partnership certificate. Divorce certificate or civil partnership dissolution certificate. Details of your employment.

How do I start receiving retirement benefits?

To qualify for retirement benefits, a worker must pay into Social Security, earning 40 credits over a minimum of 10 years, and cannot make a claim before age 62. Spouses and children also may be able to claim Social Security survivor benefits based on a worker's earnings history.

What benefits can I apply for when I retire?

Benefits in retirement State Pension. Pension Credit. One-off cost of living payment. Help with Council Tax. Help with heating costs. Health benefits. Travel and TV benefits. Benefits for war widows or widowers.

How to retire at the age of 62?

The key to retiring at age 62 is to assess your current assets, estimate future income and preferred lifestyle, including whether you're willing to work part-time, and how you'll pay for healthcare until Medicare kicks in.

What year is retirement age?

Currently, the full benefit age is 66 years and 2 months for people born in 1955, and it will gradually rise to 67 for those born in 1960 or later. Early retirement benefits will continue to be available at age 62, but they will be reduced more.

How do I apply for Social Security retirement benefits at age 62?

Form SSA-1 | Information You Need To Apply For Retirement Benefits Or Medicare Online; or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sar1 benefit form online?

Filling out and eSigning au csc retirement make is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in 2022 au csc retirement without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your au csc retirement pdf, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit 2022 au csc retirement download on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as commonwealth superannuation corporation retirement download. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is AU SAR1?

AU SAR1 refers to the Australian Suspicious Activity Report which is used to report suspicious transactions to the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Who is required to file AU SAR1?

Entities that are obligated to report under the Anti-Money Laundering and Counter-Terrorism Financing Act, including financial institutions, casinos, and certain businesses that deal with large cash transactions.

How to fill out AU SAR1?

To fill out AU SAR1, a reporting entity must provide details such as the nature of the suspicious activity, information on the individuals involved, transaction details, and any relevant supporting documentation.

What is the purpose of AU SAR1?

The purpose of AU SAR1 is to assist in the detection, prevention, and investigation of money laundering, terrorism financing, and other financial crimes.

What information must be reported on AU SAR1?

The information that must be reported includes details of the suspicious transaction, identity of the individuals involved, the amount and type of transaction, and contextual information that explains the suspicion.

Fill out your AU SAR1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Au Csc Retirement Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to au csc retirement download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.